Soaring metal prices may delay ongoing transition to clean energy

08/04/2021 / By Divina Ramirez

High metal prices may be good for miners, but they could delay the global transition to clean energy.

In its recent report titled “The Role of Critical Minerals in Clean Energy Transitions,” the International Energy Agency (IEA) said the surge in demand for minerals used in solar panels, wind turbines and batteries is straining supplies, sending prices soaring.

In particular, raw materials used in batteries are expected to garner the biggest surge in demand. For instance, the demand for lithium, an anode material in batteries, could grow over 40 times if countries want to meet the goals of the Paris Agreement, a legally binding international treaty on so-called climate change.

Furthermore, the report emphasized that a lack of investment in new mines could further increase the costs of producing clean energy technologies. “Meeting the climate goals will turbocharge demand for critical minerals,” explained Fatih Birol, executive director of the IEA.

Birol added that global efforts to transition to clean energy could definitely slow due to rising costs of minerals. Moreover, he warned that higher metal prices could outweigh any cost reductions achieved by increased production in clean energy technologies.

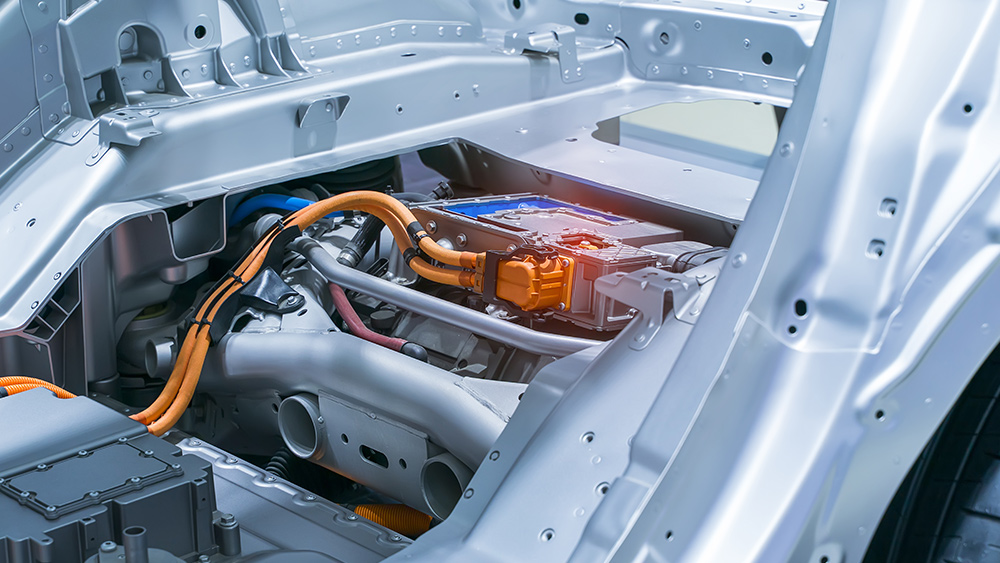

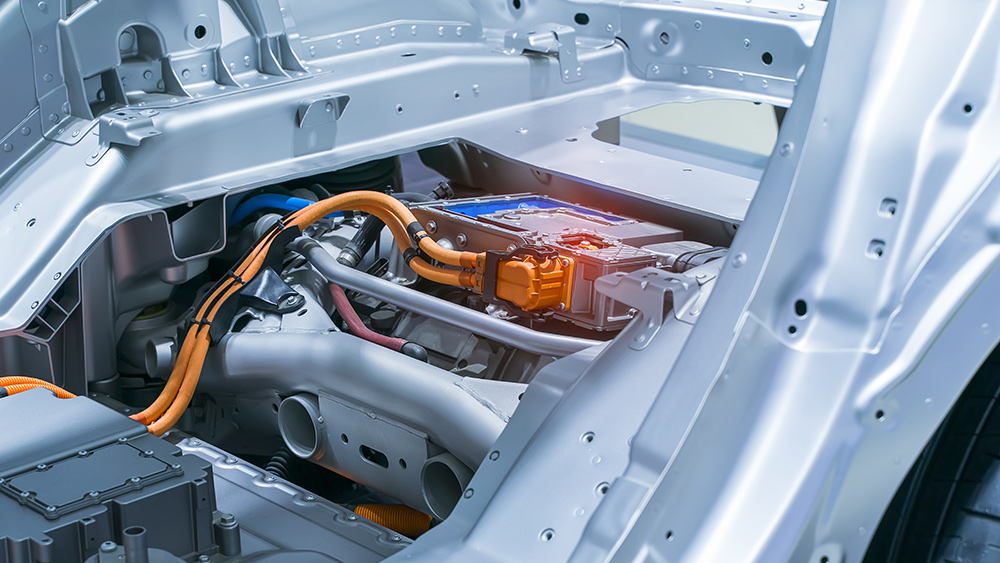

For instance, if the prices for lithium and nickel double, the cost of producing lithium batteries for electric cars could increase by up to six percent. Sales of electric cars worldwide are steadily increasing. But critical minerals need to be affordable if automakers are to keep selling these cars at affordable prices.

Copper prices, which hit a 10-year high of more than $10,000 last week, could also add half a trillion dollars to the costs of reaching climate goals in the next two decades.

According to Birol, the challenges posed by increasing metal prices are not insurmountable. That said, governments should give signals about how they plan to follow through on their climate pledges.

Critical minerals are key to energy security globally

The market price for copper, which is used in making electrical wires, rose 80 percent since last March, hitting a nine-year high. Nickel prices have also remained consistently high for over 17 months. Cobalt, which is primarily used in lithium-ion batteries, is trading close to two-year peaks.

Meanwhile, the price of iron ore, which is used to make steel, rose 85 percent, reaching highs not seen in almost a decade.

Experts suggest that the extended boom in the prices of raw materials could usher in the next supercycle. Supercycles are decade-long periods in which commodities sell above their long-term price trends. There have been only four supercycles in the past century.

But a supercycle is not enough. Investors are still not investing enough in new mines, which would need about 16 years to go from discovery to the first production. So in order to keep up with the increasing demand for minerals, investors need to start investing in new mines now, the IEA wrote.

Birol suggests that the lack of new investments could mean investors aren’t convinced governments are taking their climate goals seriously. “There is not strong enough and clear enough signals given by policymakers about the speed and determination of the energy transition.”

However, critical minerals, such as iron, nickel and copper, have become key to countries’ energy security. Birol said countries should consider stockpiling on certain critical minerals to protect themselves from an unexpected shortage if investments in new mines don’t pick up. (Related: World rapidly running out of rare minerals needed to manufacture cell phones and mobile devices.)

This kind of strategic stockpiling would be helpful, especially for minerals with few suppliers. For instance, the Democratic Republic of the Congo, a country in sub-Saharan Africa, produces more than 60 percent of the world’s supplies of cobalt.

Learn more about how high metal prices could affect different industries at MarketCrash.news.

Sources include:

Tagged Under: Clean Energy, economics, economy, energy, energy security, metal prices, metals, minerals, renewable energy

RECENT NEWS & ARTICLES

GreenDeal.News is a fact-based public education website published by GreenDeal News Features, LLC.

All content copyright © 2018 by GreenDeal News Features, LLC.

Contact Us with Tips or Corrections

All trademarks, registered trademarks and servicemarks mentioned on this site are the property of their respective owners.